Client

Description

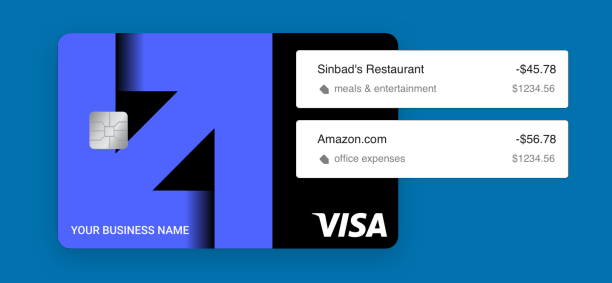

Making Entrepreneurship Accessible to All Our engineers collaborated with the Azlo team, and employed the five steps of Design Thinking: Empathize, Define, Ideate, Prototype and Test, to understand the full scope of the end-user’s needs, and the business challenges Azlo needed to manage to meet those needs. This approach enabled the team to identify a comprehensive framework of privacy requirements like GDPR, FinTech-specific cybersecurity for compliance with PCI requirements, along with the digital protocols for digital banking and task automation. In a series of agile sprints, the development team built out a wide range of mobile-first financial products accessible through an intuitive UX-UI that enabled entrepreneurs and freelancers to easily adopt the platform, and made Azlo an essential part of their business. Easy to enroll. Easy to use features. User-friendly processes, from account sign-up to new premium features, enabled the automation of numerous regular back-office financial tasks like scheduling, invoicing and budget “envelopes” to allocate for expenses like payroll and taxes. Customer satisfaction scores soared. With more people moving into the gig economy and freelance work, the Azlo founders’ vision put the company in the right place at the right time, and, thanks to a great product, the customer count recently doubled.

Challenge

Delivering fee-friendly banking to the new economy- Banks fuel economic growth by finding innovative ways to efficiently move money from savers to borrowers. From the first Western Union wire transfer in 1871, to 2019 when mobile banking passed websites as consumers’ preferred means to access their accounts, electronic banking amplified the opportunities to improve frictionless commerce between consumers and businesses at scale. For those in the traditional economy it is a boon. For those driving the new economy, it exposed a gap. In the mid-2010s, nearly 45 million Americans had a “side gig” and Azlo’s founders knew that their banking needs were different from regular businesses. Creating a digital platform that connects every financial tool- The new economy presents a variety of challenges for SMBs, entrepreneurs, and freelance workers. Limited access to low-fee business bank accounts and capital hinders growth, and whether you are a streamlined SMB or a lone wolf, integrating billing, payment and other business management software is both a financial and IT headache.

Solution

Software development skills, and the ability to anticipate what’s next. To bring their vision to life both online and on the mobile app, Azlo needed help across six different development teams to support front-end and back-end development, security, and developing and maintaining CI/CD with strategic DevOps resources. We used StaffingHero™, its proprietary matching algorithm, to identify a team of experienced engineers with a broad spectrum of development skills, a background in FinTech security protocols, and the design thinking required to anticipate future plug-in applications.