Description

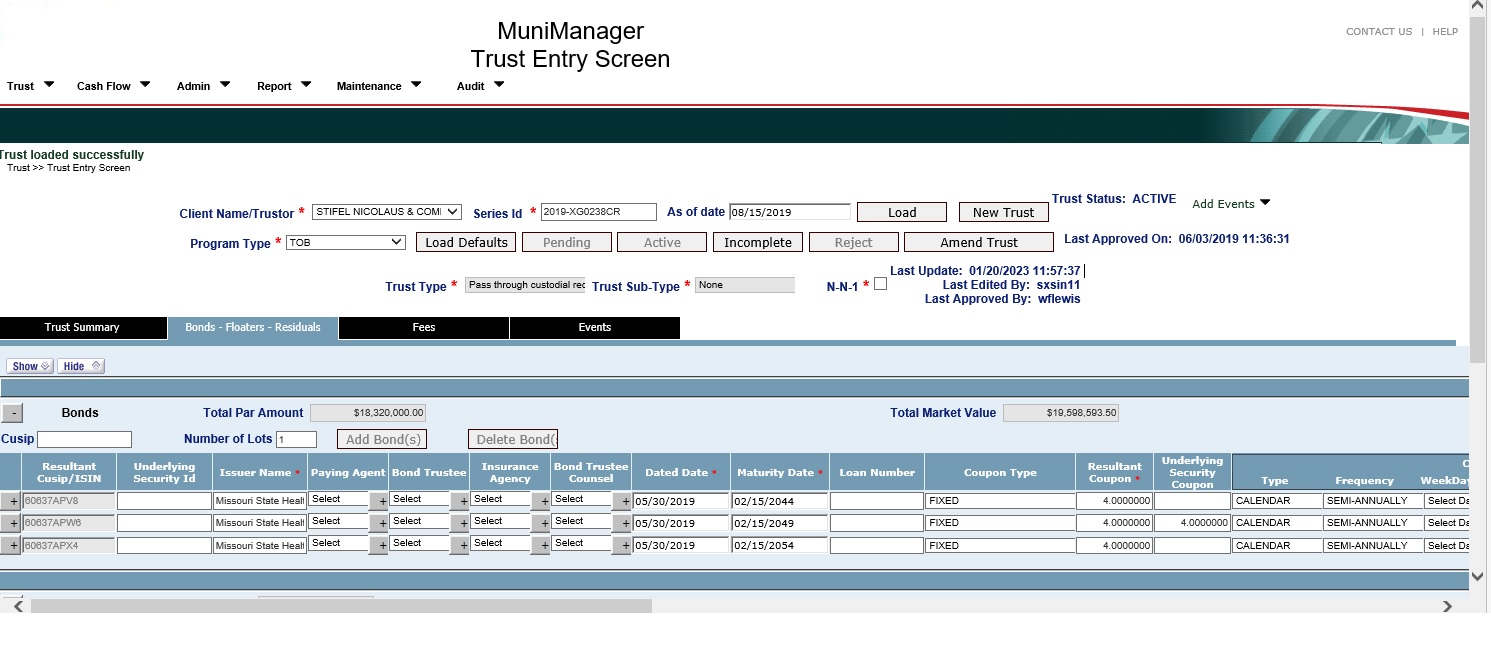

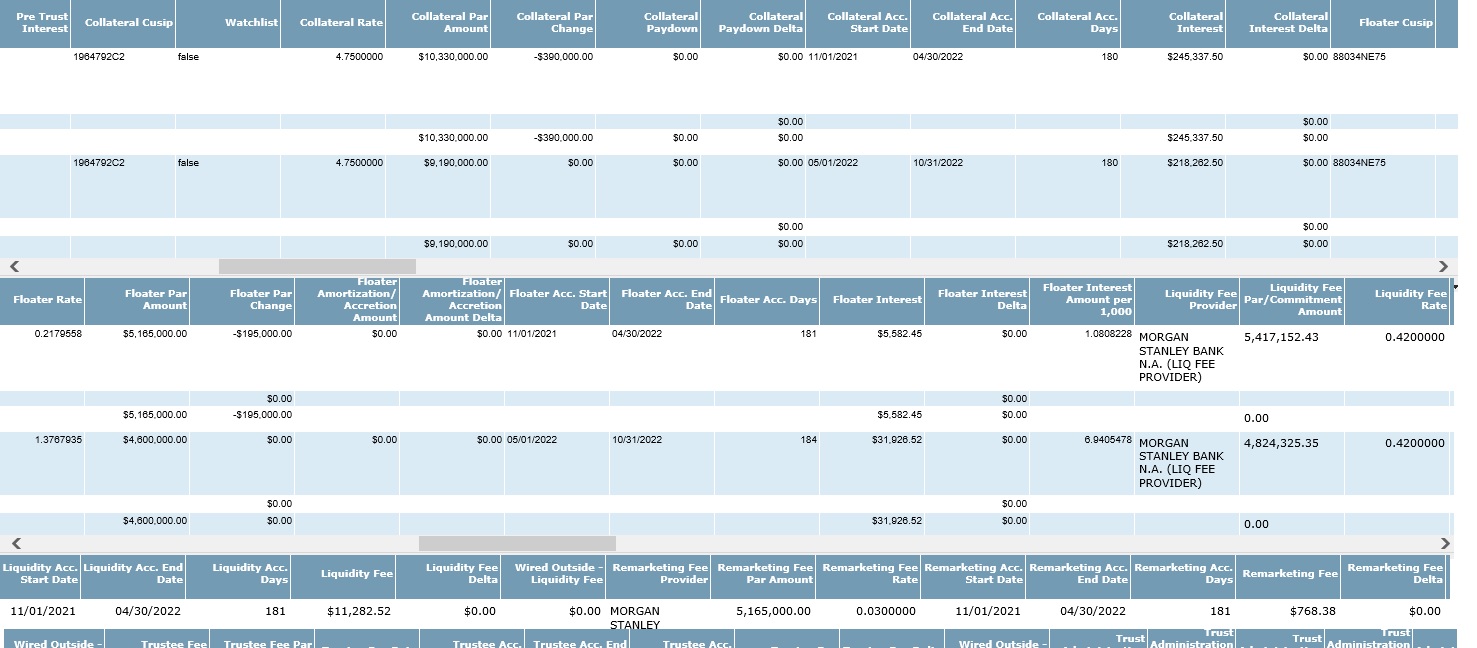

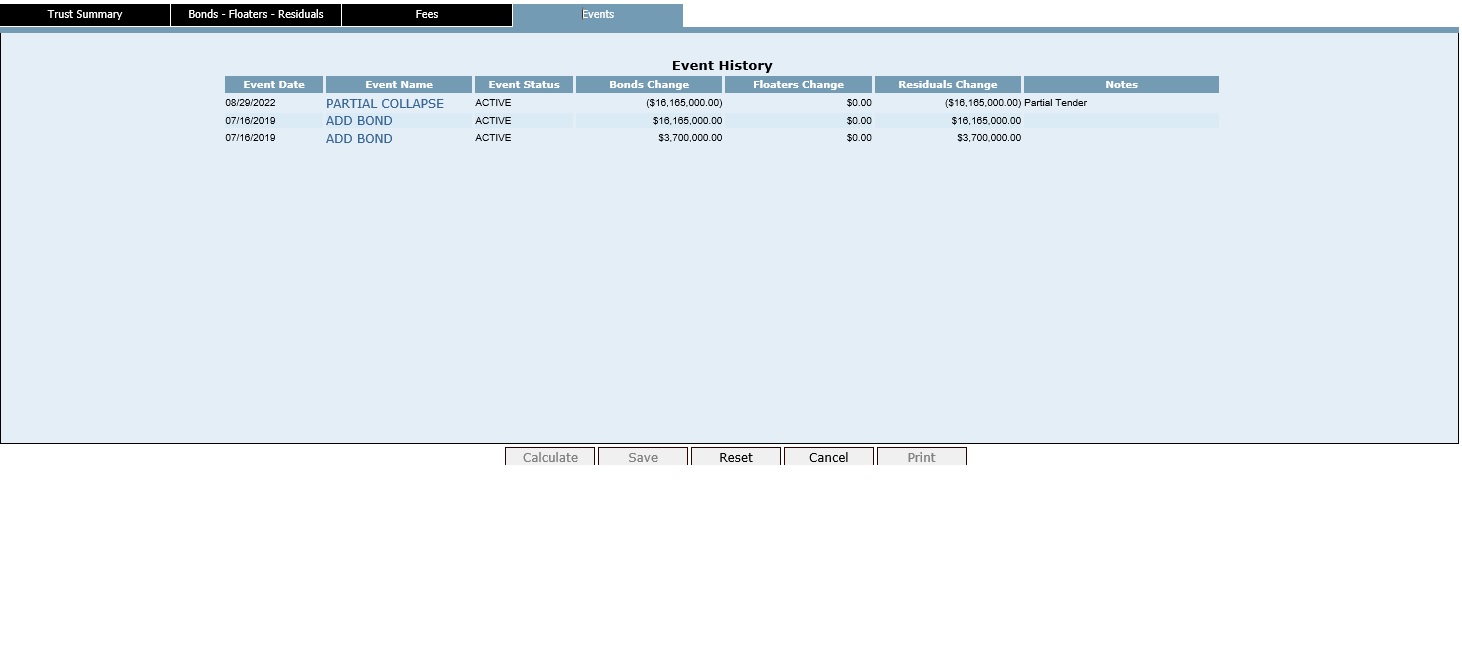

MuniManager is a comprehensive software system designed for Broker-Dealers, Trustees and Institutional Investors. The system combines trust creation and management with analytics and monitoring tools designed to save time collecting and structuring deals specifically for Tender Option Muni Derivatives.

Challenge

US Investment Banks are currently involved in the maintenance of Muni TOB programs. They typically use a combination of spreadsheets, standard and ad-hoc reports and other trading systems to track the TOB program from trust creation to termination. There was no single system which could enable the Tender Option Bond desks to enter new trades, maintain these trades and allow them to generate adequate client reports. Various groups maintain their own calculations for the trusts to generate operational reports, risk reports, position reports and accruals reports. These reports are then circulated to the various clients according to their requirements. Event data, calls and redemptions are manually entered in to the system and frequent monitoring of other Bank systems have to be performed to be aware of any upcoming events. Without a centralized system to create, track and view all trusts, compilation of aggregate statistics is a difficult and time-consuming process. Since groups work with their own set of data in the database spreadsheets, the same aggregations are repeated by different groups. The generation of payment date reports in various formats represents another challenge. Such difficulties not only limit the Tender Option Bond desks to be continuously involved in the required report generation but also limit the scalability of the operations. Since its inception, the TOB program has continuously evolved; many practices, conventions and rules have been changed. Due to an absence of a centralized tracking system, a number of fields and values that may be required are being left to be tracked in hard copies or through multiple internal systems. This arrangement presents several problems. Firstly, different individuals maintain different sets of data in their own spreadsheets, and therefore advances to one program cannot be leveraged for other programs. Secondly, due to the inherent nature of shared files, the spreadsheets do not allow concurrent users. This isolation becomes specially taxing on payment dates where a number of trusts may need to be modified. Current processes of updating the spreadsheets with position changes and weekly rates and then DTC with the changes in Floater positions and amounts require duplicate manual updates. This is not an ideal scenario. Manual entry of the same changes in the positions and amounts is very inefficient. This task is especially taxing considering the large number of trusts being managed by the Tender Option Bond desks at Bank. The clients repeatedly requested more reporting as well as automated feeds to synchronize the data with Bank. Some of these requests have to be manually serviced daily and others can only be performed infrequently. Certain types of information cannot be stored historically in the spreadsheets due to the immense amount of data this would generate. Consequently, both performance and capacity are constraints affecting the current process of managing the trust program. There is also risk associated with the location of data on spreadsheets.

Solution

Functionality HIghlights: (1) A centralized database and system for trust programs. (2) Historical data, comparison to prior periods. (3) All major trust types supported. (4) Customized reports. (5) Support for events and activities for regular maintenance of active trusts along with regeneration of amortization and accretion schedules as necessary. (6) Complete audit trail Trust-Structuring Editor: (1) multiple underlying assets (2. lot entry (3) allocation methods for matching multiple floater and residual certificates with underlying assets, (4) upfront and ongoing fees specifications (5) audit tracking of changes (6) amortization and accretion schedule generation (7) ticketing of settlement costs (8) automated links to third party sources for bond reference data. Cash-Flow Generator: (1) various asset classes; VRDN, Fixed Rate, Zero Coupons, Step Up coupons, etc. (2) daily flows aggregated by period or a range of dates (3) floater and residual interest computations events. A centralized database and a system for various TOB programs will produce a number of Benefits: (1) Innovations to the trust programs will be much easier by the implementation in a single, centralized system. (2) Every user will have access to different parts of the same system. (3) The cashflow generator will be the same for all types of reports and data generation for export to other systems. This will eliminate the possibility of errors introduced through the use of multiple spreadsheets managed by different users. (4) The system will reside on the firm’s centrally supported data servers, ensuring robust and rapid access. The issue of delays due to errors or losses due to hardware or software errors is addressed through a database system that has duplication of data, failsafe recovery mode, and traceable, recorded audit logs of all changes to the data. (5) Processing by the different user groups will be streamlined, saving time, effort and resources. The system will have sufficient capacity to house all trust programs in one system. Historical data will be stored allowing for comparison to prior periods. Specialized code will generate data values required by internal systems or user reports and these reports will be more user-friendly. The need for duplicate entry of various values will be eliminated and single consistent value will be maintained for each field. It will be much easier to generate aggregate statistics. (6) The functionality for detecting upcoming events, track and renew expirations of various fee parameters, tracking of interest rate changes, redemption notices etc. would help serve the clients of Bank better. Better tracking of these fields will aid in more accurate and frequent reporting to the clients. (7) Automated position reports and payment data reports will reduce errors incurred in manual entry of events details. Uniform rules implemented, tested, and checked in a single system eliminates the duplication of calculations required in a separate spreadsheet-based process.